loan management

system

audited infrastructure - all in one platform.

![[object Object]](/_next/static/media/loan-origination.3ad55a6a.svg)

records

![[object Object]](/_next/static/media/data-ingestion.3b960c5c.svg)

tracking

![[object Object]](/_next/static/media/accounting-treatment.17e915ff.svg)

treatment

compliance

automation

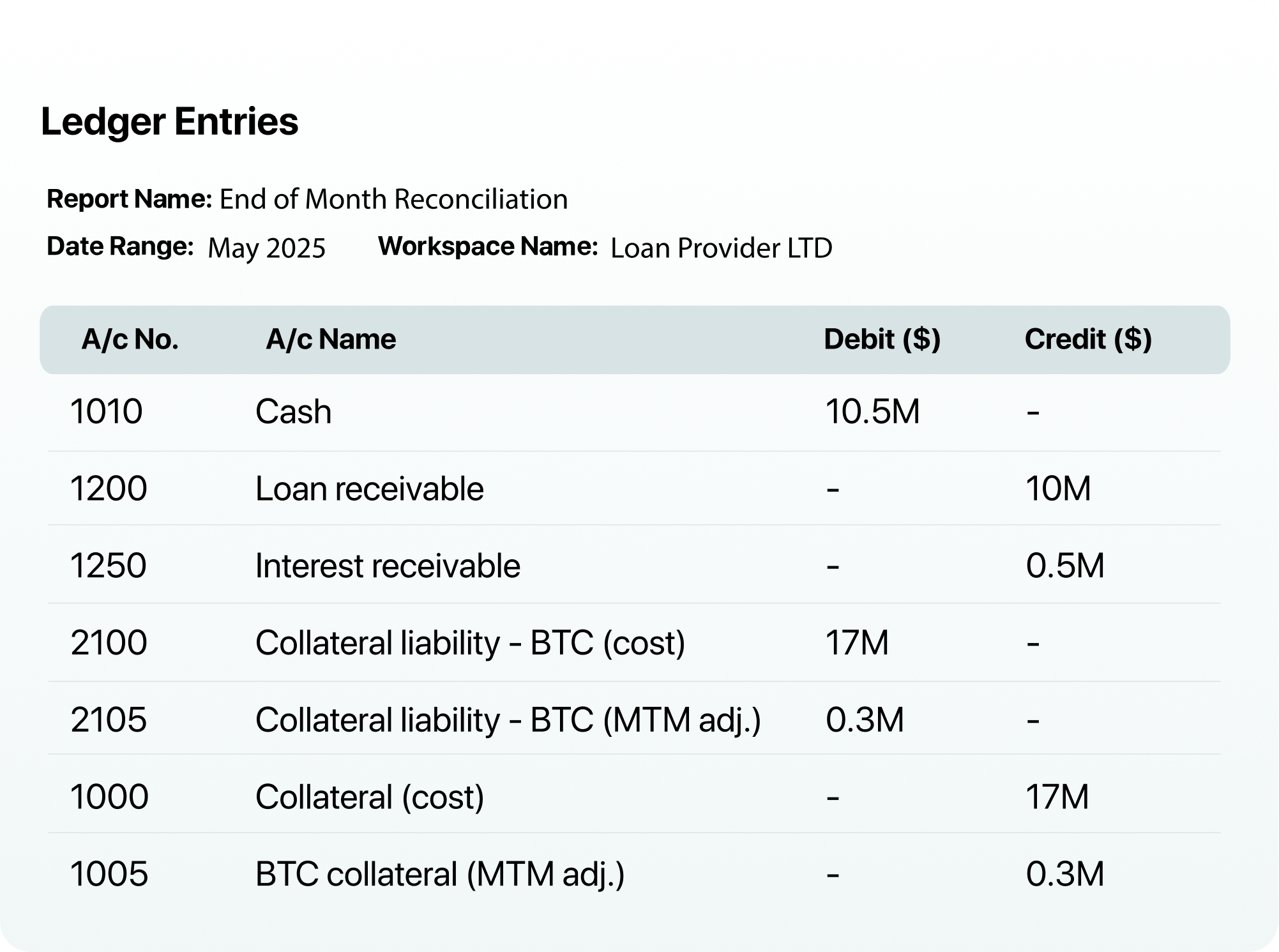

reconciliation

![[object Object]](/_next/static/media/audit-ready-reporting.4915f3b3.svg)

reporting

dashboards

IFRS reporting

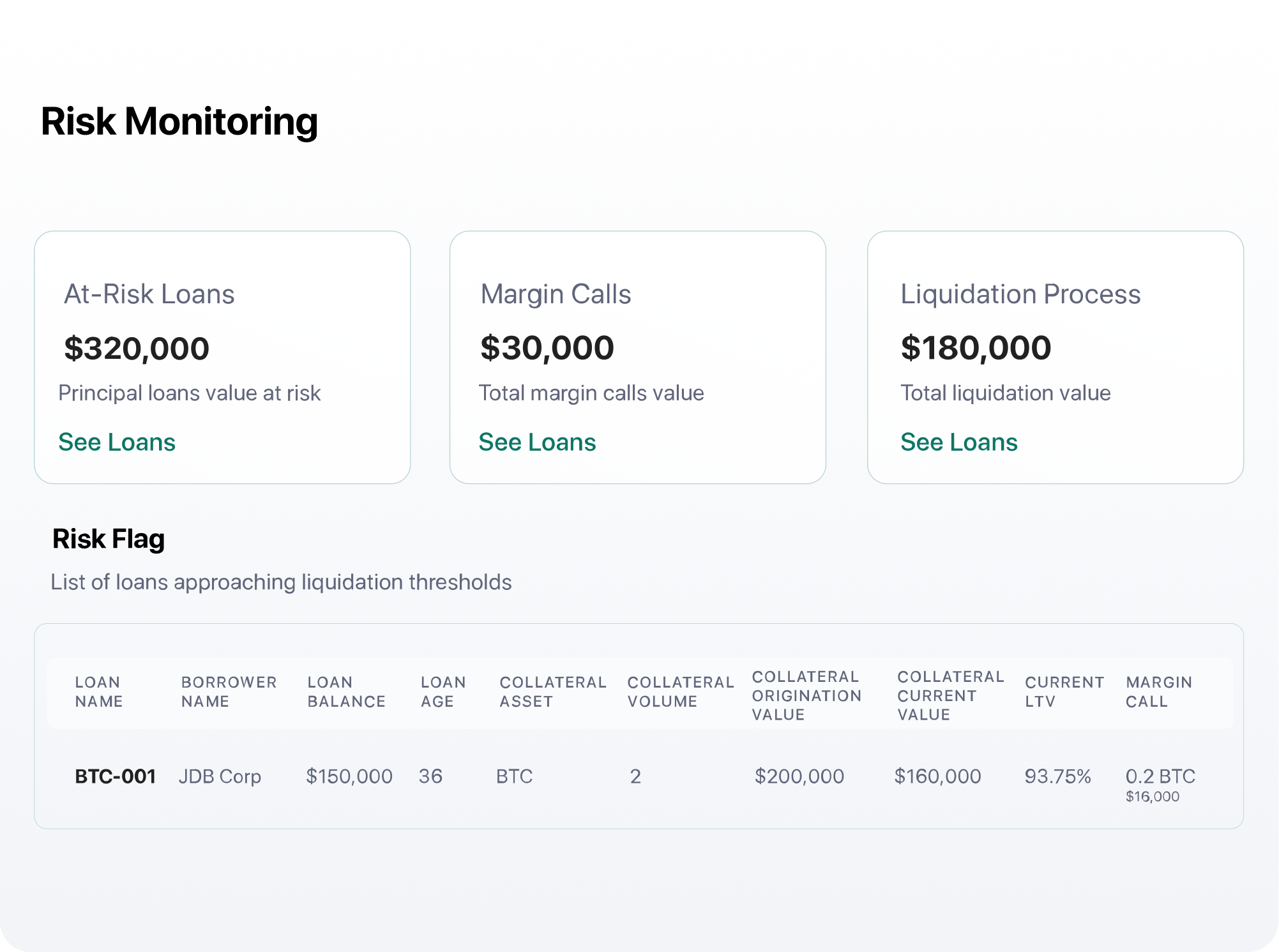

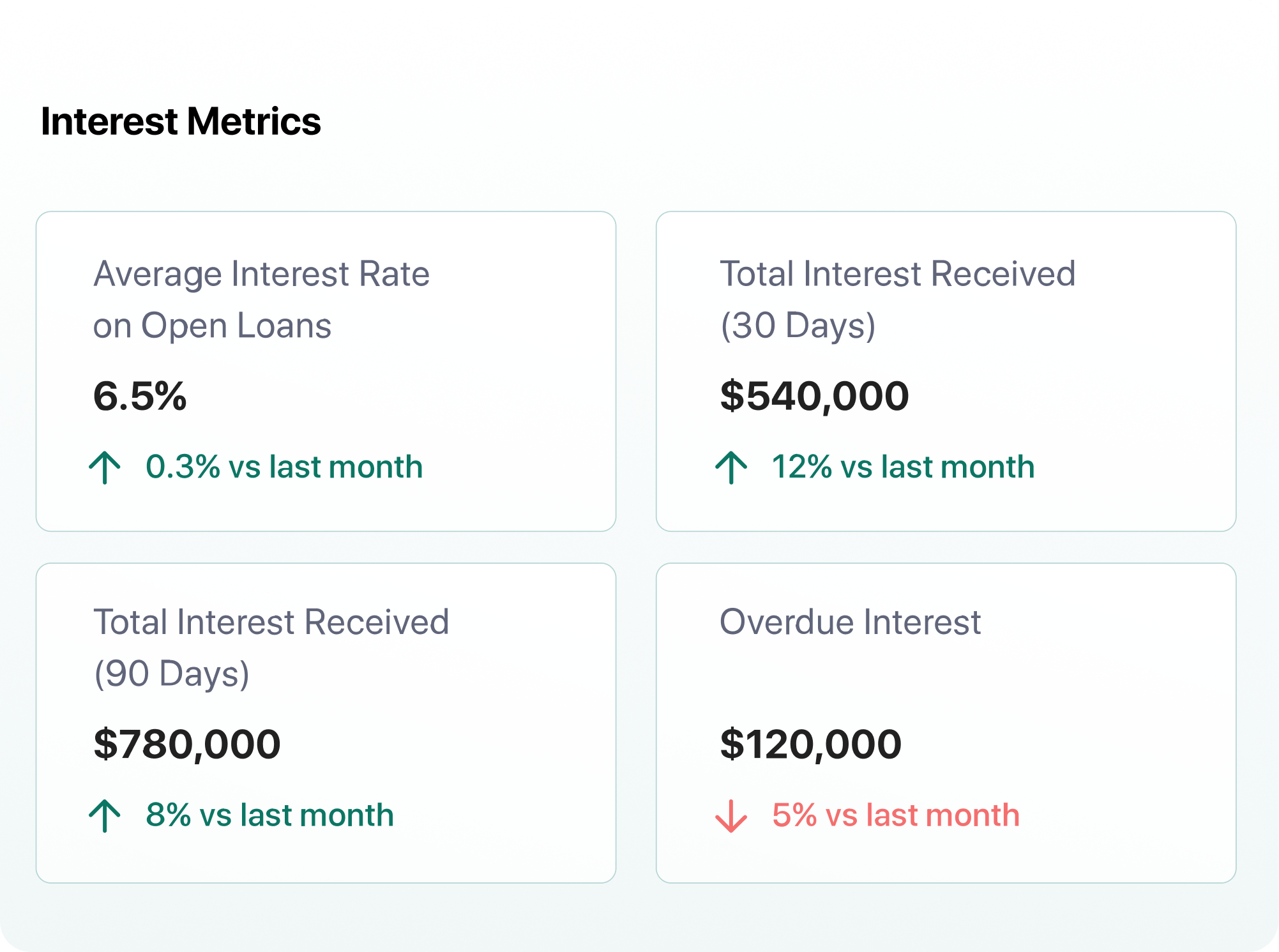

health

reporting and compliance

Speak to one of our experts for a free discovery consultation.